There is a lot of financial advice out there that can help you build wealth and reach your financial goals. There’s also plenty of misinformation that can set you back. This month, I want to highlight five common money myths to avoid in the new year, as well as good advice you can take to the bank.

Myth 1. There’s no reason to save for retirement when you’re young. It’s easy to put off retirement saving when you’re young — I mean, it’s so far off and you have other priorities like buying a car or raising a family. But if you wait to save for retirement, you’re missing a huge opportunity.

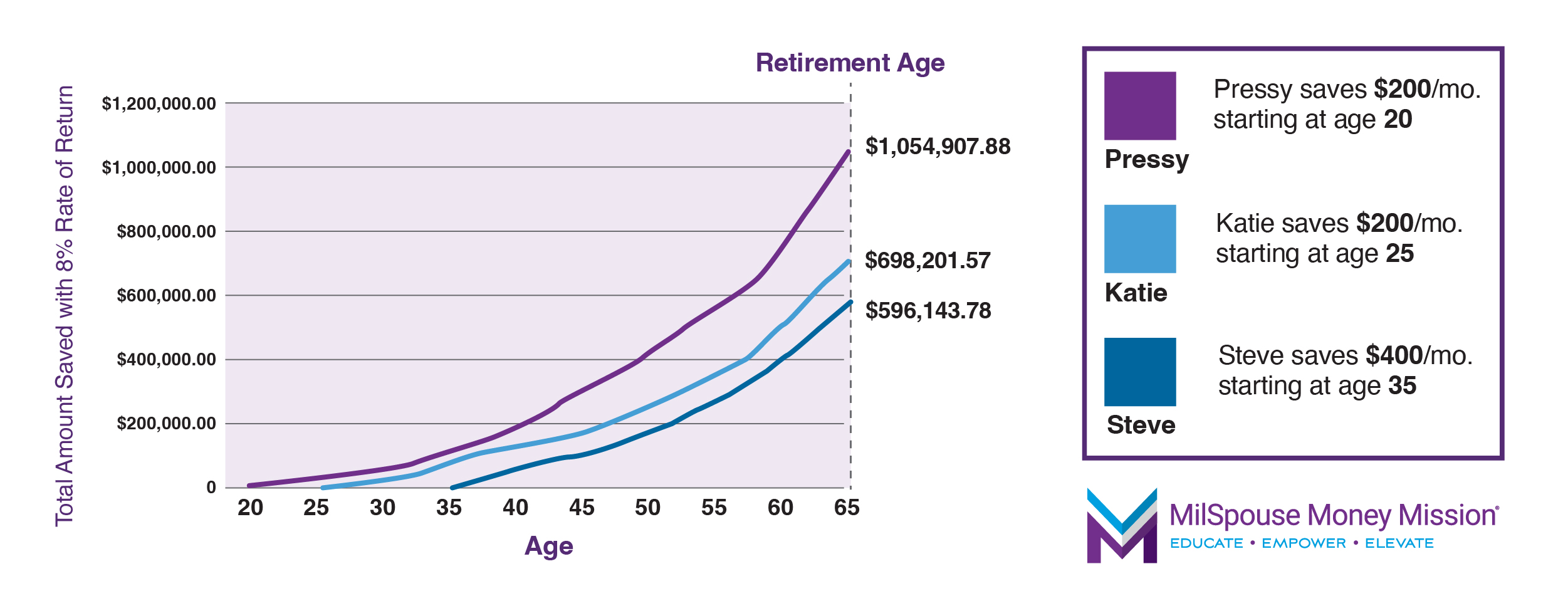

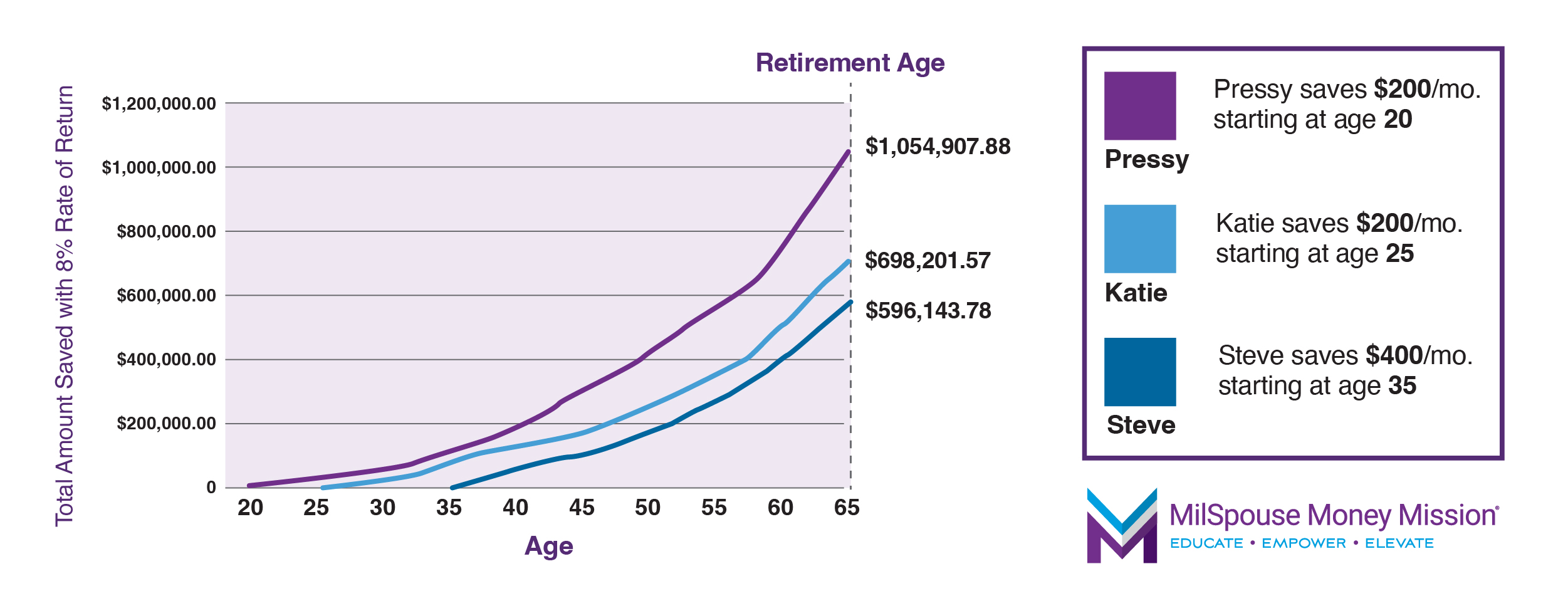

The key to successful retirement savings is compound interest and time. With compound interest, your retirement account — whether a Thrift Savings Plan, 401(k) or something else — pays you interest not only on the money you deposit but also on the interest your money earns. So the longer you save, the faster your money grows. Let’s see how this works.

Pressy, Katie and Steve all want to save for retirement. Pressy starts at age 20 saving $200 per month. Katie starts at age 25 saving the same $200 per month. Steve waits until age 35 and tries to play catch-up by saving $400 per month. Assuming the same 8% rate of return for each of them, see the chart below for their results. Even though Pressy only saves $12,000 ($2,400 for five years) more than Katie, she ends up with over $350,000 more by age 65. Steve, by age 65 has significantly less than both, despite saving more.

Get the picture? With the magic of compound interest, time is on your side the sooner you start saving for retirement.

Myth 2: Buying a home is better than renting. It is a common belief that you need to own a home to build wealth. When you rent, you lose out on gaining equity in a home, and home values tend to go up over time, giving you a tidy profit when you sell. So buying is always a better choice than renting, right?

Yes and no. Typically, the longer you are able to own your home, the larger the value is likely to increase and you begin to build equity. One consideration when you buy a home is the substantial upfront expenses such as closing costs, fees and set up costs. It’s important to know your breakeven point – or said another way, the amount of time it takes to build enough equity to earn back all of the upfront costs. Before making any decisions, it’s wise to calculate the values of renting versus buying based on taxes, fees and other expenses.

For many military families who move frequently, renting might make the most financial sense. But if you are able to stay in one place for many years — or plan to rent your home to tenants — owning a home may be a good way to put down roots and build wealth.

Myth 3: I don’t earn enough to save. This is certainly understandable especially with high prices and inflation. But setting aside even a small amount will help.

If you can find just $20 a week to set aside, in one year you will have $1,040 which is a solid start to building an emergency fund. You might have to look at giving up one subscription or take a little extra time to pack a lunch during the week, but what might seem small can add up quickly.

Here are some tips to help you save:

- Automatically transfer a portion of your pay to a savings account through a direct deposit. That way, you may have less temptation to spend the money.

- Consider banking some of the “extra” money that comes your way, such as pay and longevity increases, bonuses, tax refunds and gift money.

Myth 4: Paying only the minimum on a credit card is fine. When your credit card bill comes due, it’s tempting to simply pay the minimum required amount. This way, you pay a smaller amount, and you avoid late fees. Unfortunately, when it comes to credit cards, if you don’t pay in full and you carry a balance, you end up paying more in the long run and taking longer to pay off the debt. Credit cards can have very high interest rates — like 18%. For example, if you carry an average credit card balance of about $3,000 at 18% for just one year, you’ll be charged around $540 in interest!

So you can imagine how only paying the minimum payments each month makes it incredibly challenging to pay off your balance AND the interest that’s building. Ideally you want to pay in full each month, but if that’s not feasible, strive to pay more than the minimum payment and be sure to know all the basics of how best to manage your credit cards.

Myth 5: Giving up your daily coffee purchase will set you up for financial success – You’ve likely heard this before. Give up your daily $5 caffeine fix, and you’ll save about $100 per month, right?

Making small adjustments like this can add up over time, but the more important financial decisions are your major purchases. What you decide for housing, cars, electronics and more will make a larger impact on your overall financial trajectory.

The Real Deal

In summary, falling for these myths can impact your finances and hold you back. Instead, use SMART planning to set clear money goals and establish a long-term strategy to achieve them. And don’t forget, as part of the military community, you have access to no-cost financial counseling services to help you achieve and maintain financial readiness for you and your family.

Mandi Moynihan is a CERTIFIED FINANCIAL PLANNER™ professional who has been with MilSpouse Money Mission since its inception. She also served in the Army and is the spouse of a retired service member.

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward military spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!

MilLife Milestones

Personality Quiz

Next Blog

There is a lot of financial advice out there that can help you build wealth and reach your financial goals. There’s also plenty of misinformation that can set you back. This month, I want to highlight five common money myths to avoid in the new year, as well as good advice you can take to the bank.

Myth 1. There’s no reason to save for retirement when you’re young. It’s easy to put off retirement saving when you’re young — I mean, it’s so far off and you have other priorities like buying a car or raising a family. But if you wait to save for retirement, you’re missing a huge opportunity.

The key to successful retirement savings is compound interest and time. With compound interest, your retirement account — whether a Thrift Savings Plan, 401(k) or something else — pays you interest not only on the money you deposit but also on the interest your money earns. So the longer you save, the faster your money grows. Let’s see how this works.

Pressy, Katie and Steve all want to save for retirement. Pressy starts at age 20 saving $200 per month. Katie starts at age 25 saving the same $200 per month. Steve waits until age 35 and tries to play catch-up by saving $400 per month. Assuming the same 8% rate of return for each of them, see the chart below for their results. Even though Pressy only saves $12,000 ($2,400 for five years) more than Katie, she ends up with over $350,000 more by age 65. Steve, by age 65 has significantly less than both, despite saving more.

Get the picture? With the magic of compound interest, time is on your side the sooner you start saving for retirement.

Myth 2: Buying a home is better than renting. It is a common belief that you need to own a home to build wealth. When you rent, you lose out on gaining equity in a home, and home values tend to go up over time, giving you a tidy profit when you sell. So buying is always a better choice than renting, right?

Yes and no. Typically, the longer you are able to own your home, the larger the value is likely to increase and you begin to build equity. One consideration when you buy a home is the substantial upfront expenses such as closing costs, fees and set up costs. It’s important to know your breakeven point – or said another way, the amount of time it takes to build enough equity to earn back all of the upfront costs. Before making any decisions, it’s wise to calculate the values of renting versus buying based on taxes, fees and other expenses.

For many military families who move frequently, renting might make the most financial sense. But if you are able to stay in one place for many years — or plan to rent your home to tenants — owning a home may be a good way to put down roots and build wealth.

Myth 3: I don’t earn enough to save. This is certainly understandable especially with high prices and inflation. But setting aside even a small amount will help.

If you can find just $20 a week to set aside, in one year you will have $1,040 which is a solid start to building an emergency fund. You might have to look at giving up one subscription or take a little extra time to pack a lunch during the week, but what might seem small can add up quickly.

Here are some tips to help you save:

- Automatically transfer a portion of your pay to a savings account through a direct deposit. That way, you may have less temptation to spend the money.

- Consider banking some of the “extra” money that comes your way, such as pay and longevity increases, bonuses, tax refunds and gift money.

Myth 4: Paying only the minimum on a credit card is fine. When your credit card bill comes due, it’s tempting to simply pay the minimum required amount. This way, you pay a smaller amount, and you avoid late fees. Unfortunately, when it comes to credit cards, if you don’t pay in full and you carry a balance, you end up paying more in the long run and taking longer to pay off the debt. Credit cards can have very high interest rates — like 18%. For example, if you carry an average credit card balance of about $3,000 at 18% for just one year, you’ll be charged around $540 in interest!

So you can imagine how only paying the minimum payments each month makes it incredibly challenging to pay off your balance AND the interest that’s building. Ideally you want to pay in full each month, but if that’s not feasible, strive to pay more than the minimum payment and be sure to know all the basics of how best to manage your credit cards.

Myth 5: Giving up your daily coffee purchase will set you up for financial success – You’ve likely heard this before. Give up your daily $5 caffeine fix, and you’ll save about $100 per month, right?

Making small adjustments like this can add up over time, but the more important financial decisions are your major purchases. What you decide for housing, cars, electronics and more will make a larger impact on your overall financial trajectory.

The Real Deal

In summary, falling for these myths can impact your finances and hold you back. Instead, use SMART planning to set clear money goals and establish a long-term strategy to achieve them. And don’t forget, as part of the military community, you have access to no-cost financial counseling services to help you achieve and maintain financial readiness for you and your family.

Mandi Moynihan is a CERTIFIED FINANCIAL PLANNER™ professional who has been with MilSpouse Money Mission since its inception. She also served in the Army and is the spouse of a retired service member.

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward military spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!

MilLife Milestones

Blended Retirement System: A Guide for Seasoned Spouses

The Blended Retirement System: By now, many military spouses have heard a great deal about the new Blended…

Read MorePersonality Quiz