MILSPOUSE BLOG

Talking Money with Your Partner As we celebrate loving relationships this month, it’s important to remember that not all conversations come up roses between couples. Sometimes discussing finances can be tricky and stir up negative emotions. Open communication about money is vital for building trust and nurturing a healthy relationship. Whether you’re a new couple…

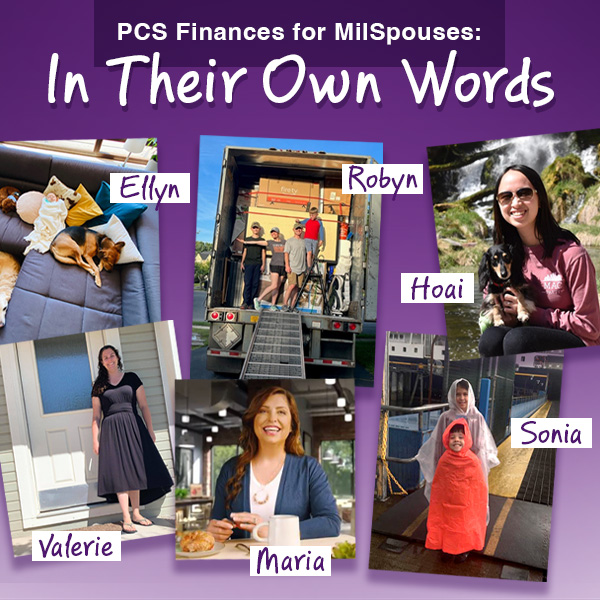

Read MoreDid you set financial goals earlier this year only to have a permanent change of station (PCS) threaten to derail your family’s budget? You’re not alone. Other MilSpouses have learned how to keep their family finances intact during a move — and so can you! Here is valuable advice from their experiences. PCS-proof Your Finances…

Read MoreMilSpouses are often asked to shoulder a big load of responsibility. When partners deploy or work long hours, managing career and home responsibilities — especially finances — can fall on them. In honor of Military Spouse Appreciation Day, we pause to celebrate your unwavering support, strength and resiliency in all you do for your service member,…

Read MoreDuring Month of the Military Child, we pause to recognize the sacrifices and highlight the resiliency of military children. As we celebrate their unique experiences, take a moment to consider how their exposure to big life events, like a PCS, impacts their understanding of financial well-being. The money lessons we teach our children while they’re…

Read MoreStay Financially Fit for Summer Fun It’s March, the time of year I start dreaming about warm beaches, longer days and vacation travel. I know I need to plan now for that getaway and other things summer brings like camps for kids, possible vacations and maybe even a PCS. Here are some planning resources that…

Read MoreThere is a lot of financial advice out there that can help you build wealth and reach your financial goals. There’s also plenty of misinformation that can set you back. This month, I want to highlight five common money myths to avoid in the new year, as well as good advice you can take to…

Read MoreImproving financial fitness is more than a money matter — it can also help reduce the stressors that can negatively impact your physical and mental health. Research links financial stress to health conditions like high blood pressure, migraines, anxiety, sleeplessness, and depression. Money can’t buy happiness, but being in control of your finances goes a…

Read MoreYou wouldn’t prepare your holiday meals without your favorite recipes, so start this season with a savings plan. Think of it as your very own recipe for financial success. It may seem early to be talking about the holidays, but as a mother and a CERTIFIED FINANCIAL PLANNER™ professional, the best tip I can offer…

Read MoreIf you’re like me, I had thoughts of chilling my favorite beverage in preparation for the first day of school when my girls were younger. 😉 I was also thinking about all the money I’d have to spend getting my kiddos ready. Back-to-school shopping is so much more than buying pencils, notebooks and rulers. It’s…

Read MoreI love PCS season! After 10 moves in the last 19 years, I still thrive on turning my type-A, task-driven mind into a weapon of mass organization. Last spring, my dear husband came with orders for a cross-country move. Due to the logistics of having to coordinate multiple travel plans over five weeks, we chose…

Read More