Set Goals and Make a Plan

Set Goals and Make a Plan

Setting financial goals can seem difficult in the military as our cost of living and funds tend to vary by geographical location. Our first step toward setting financial goals was establishing a budget. We put on paper exactly where every dollar was going and looked at what was necessary versus what was a want. Living within your means is very important!

Then we started a savings regimen. We set aside a certain amount to put into our savings each month and when our finances allow us to, we increase our contribution!

It’s also important to think about the future! I recommend setting up and contributing to your TSP, even if it is only a small amount. You never know where you will be in 20 years, and every little bit helps. It is NEVER too early to save a few dollars.

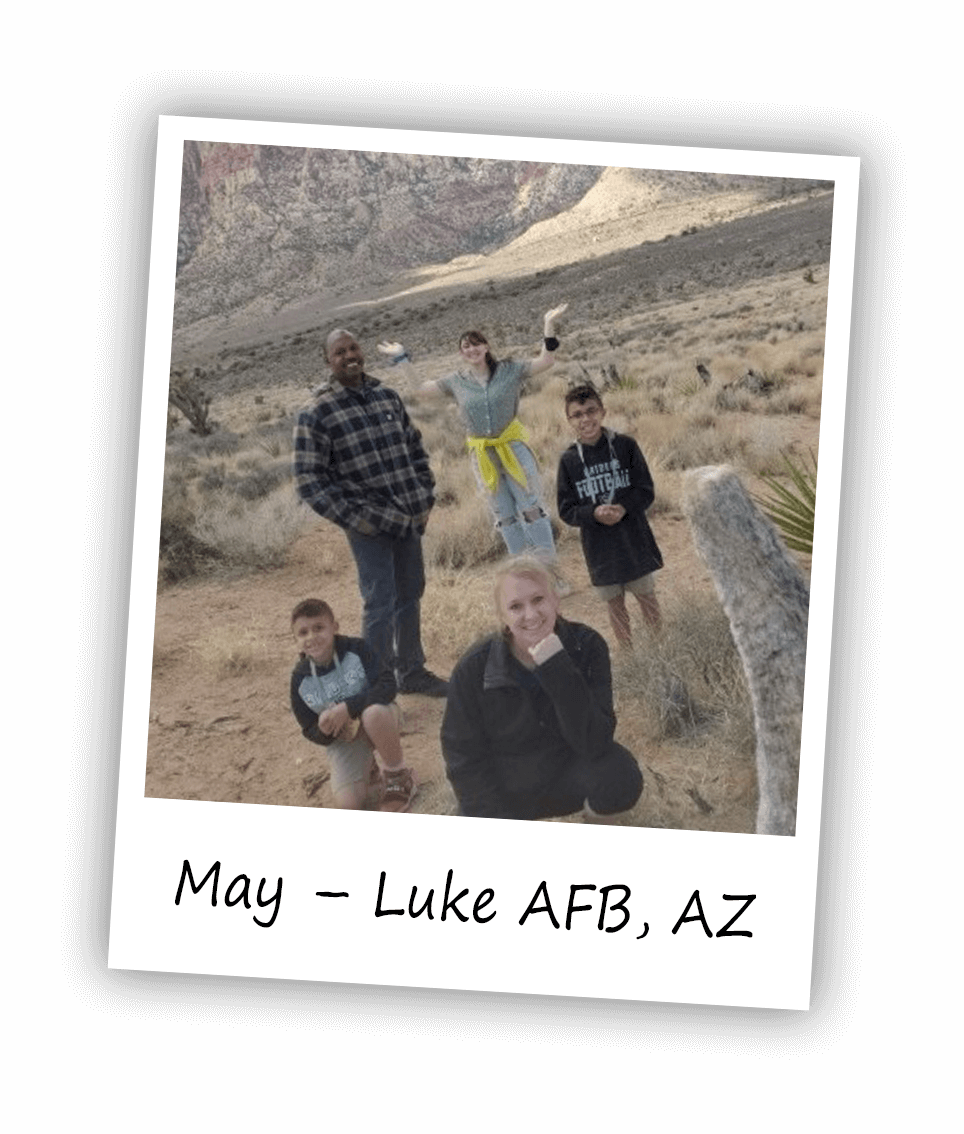

Part of financial goals is saving for vacation! We recently went on a family trip to explore this amazing country of ours. This is us at Red Rock Canyon, Nevada, on our Las Vegas trip!

MilSpouse Money

Mission Response:

Thank you for sharing your tips and experiences, May! Vacation is a fun savings goal to plan for and it looks like your family had a great time in Nevada!

Like May mentions, a critical step to achieving long- and short-term financial goals is to know where your money is going each month. A budget, also called spending plan, helps you stay on track and allocate your spending to cover your financial needs and wants. Income and expenses can fluctuate for a variety of reasons including PCS, promotion, welcoming a new child, etc. Make sure to adjust your spending plan as your situation changes. Check out our worksheet for help getting started.

One of the most important (and expensive) goals we will save for is retirement. Whether your spouse is covered under the Legacy Retirement System or Blended Retirement System, they have the ability to contribute to the Thrift Savings Plan (TSP), a tax-advantaged retirement account. You and your spouse may also consider contributing to your Individual Retirement Account (IRA), which is another tax-advantaged account with the purpose of saving for retirement. Financial experts recommending saving 10%-15% of pretax pay toward this goal. If this seems like a lot, or you have other financial obligations that prevent you from saving this much, save what you can and increase it as possible.