1

Getting Started

Your spouse is retiring from the military. Congratulations! What happens next? The transition from the military to civilian community is a challenging task for the service member, but also for his or her entire family.

There are many things you can do as a military spouse to prepare for this new phase of life. Your service member is required to submit documentation and attend training throughout the transition process. Did you know that many of these trainings are open to spouses? Take advantage of available tools and resources to help smooth the transition process and help you and your spouse gain the skills and confidence to tackle your next chapter in the civilian sector.

The transition from active duty to civilian life is complex and can include a job search, relocation, and a major shift in lifestyle and community. Every family’s situation is unique and your experience during transition depends on your situation. We have compiled suggestions and guidelines to help you get your financial picture in focus and prepare for this new phase.

Let’s first hear from Kristin, an Army spouse, about how transitioning out of the military is a family affair. Watch this video to learn tips to tackle this change with your spouse.

2

Financial Planning Considerations

Many aspects of your financial life will require your attention as your spouse retires from active duty to civilian status including insurance, retirement and estate planning.

Know your health insurance options and have a plan in place before retirement. Please note, most of these programs have windows of eligibility, so make sure your family has a plan to prevent any gaps in coverage. Make sure to acquire a copy of health care records for all members of your family before retirement. Here are options to consider for health care coverage for life after the military:

- Enroll in TRICARE Health coverage after retirement. Visit this link for next steps and health plan options.

- Acquire civilian health insurance sponsored by your new employer.

- Continued Health Care Benefit Program (CHCBP) — This program is like a premium-based civilian sponsored plan. Coverage is limited to 18-36 months and must be purchased within 60 days of separating from service. Click here for more information.

- Transitional Assistance Management Program (TAMP) — This program is available to some members transitioning from active duty. Visit this resource for more information.

- Veterans Administration Healthcare — This may be an option for health care coverage for your spouse as he or she transitions out of the military. However, the VA does not provide coverage for family members. Click here to find information on eligibility requirements.

Your spouse was likely covered under Servicemembers’ Group Life Insurance (SGLI) while on active duty. SGLI coverage typically ends 120 days after separation from service, so, assuming you still need coverage, make sure you have new life insurance in place before it expires. Assess what your life insurance needs are with the help of our videos.

One option for coverage is through the Veterans' Group Life Insurance (VGLI) program, which is administered by the VA.

VGLI is a program that allows you to continue life insurance coverage after you separate from service. Veterans can apply for coverage within 1 year and 120 days after separation from service. If your spouse applies for coverage within 240 days of separation, he or she will not be required to submit health-related information. VGLI provides coverage as long as you pay the premiums, which are based on the veteran’s age. Please note, the amount of coverage your service member may enroll for under VGLI is based on the amount of SGLI coverage he or she had when they left the military.

VGLI is often a good option for veterans with health conditions that may make coverage through a private insurance company very expensive or impossible.

Compare the cost of life insurance through VGLI and other insurance companies to see what will be most affordable and meet your family’s needs.

As a spouse, make sure you have life insurance coverage, too. Our resource, Money Ready 201: Insure Your Family, provides more information on this important topic.

The military rolled out the new Blended Retirement System (BRS) on January 1, 2018 for anyone joining the military from that point forward. Those with less than 12 years of service at that time (4,320 retirement points for Guard and Reservists) were given a one-year window to opt in to BRS, if desired. If they did nothing, they remained in the legacy system. It is critically important to understand which system your spouse is covered under to know what retirement benefits they may receive.

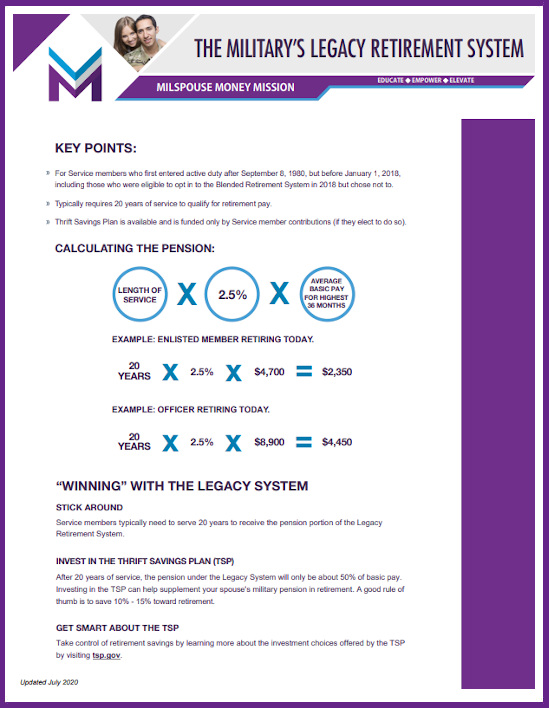

Many spouses with service members closer to retirement have only experienced the Legacy system. These service members must typically stay in for 20 years to get any type of DoD-funded retirement benefit. As illustrated below, their monthly pension is based on a calculation that uses a factor of 2.5%, years of service, and an average of the highest 36 months of basic pay.

Here is how it is calculated:

For the Guard and Reserve, divide accumulated retirement points by 360.

For more details, download this PDF.

What is the BRS? At a high level, it is a retirement program that blends DoD funding of a traditional pension with automatic and matching contributions to the TSP. The pension component under the BRS is 20% smaller than the pension under the legacy system; however, service members may receive DoD-funded contributions of up to 5% to their TSP account. Eligibility for the pension in BRS is the same as the legacy system, which typically is completing 20 years of service. Here is how the pension is calculated under the BRS:

For the Guard and Reserve, divide accumulated retirement points by 360.

For more details, download this PDF by clicking below.

Military Pension:

- Upon retirement after at least 20 years of service on active duty, your service member will receive a monthly pension for their lifetime. This is a significant change to your household income to consider when determining your next steps as a family. The pay will also receive a periodic adjustment to the cost-of-living index.

- Upon retirement, your service member will be required to make an election on the Survivor Benefit Plan (SBP). If elected, the SBP provides an eligible beneficiary with a benefit called an “annuity” if the retiree dies. This annuity is a monthly payment for the lifetime of the beneficiary and is a percentage of the service member’s retirement pay. Enrollment is not automatic and there are costs. Be sure to do your homework BEFORE retirement so you know what is best for your situation and make the appropriate election for your family. Visit DFAS For more information.

- If your service member falls under the BRS, there is a lump sum option which gives them a choice at retirement. Service members who qualify for retired pay may be eligible to elect either a 25% or 50% discounted pension payment in exchange for a lump sum payout. Monthly retired pay returns to the full amount when the service member reaches their full Social Security retirement age, which for most is age 67. Click here for more information.

Guard and Reserve Retirement Pay:

- Guard and Reserve duty personnel are generally eligible for retired pay after completing at least 20 years of service and reaching 60 years of age. The amount of pay is based on a point system geared toward the amount of active and inactive duty performed.

- Guard and Reserve members may be eligible to receive retired pay before 60 years of age based on qualifying active duty service.

- Guard and Reserve members will receive retired pay for life. The pay amount is periodically adjusted to the cost-of-living index. Upon the death of the service member, a spouse and/or children may receive payments only if the SBP was elected. For more information about the Reserve Component Survivor Benefit Plan, click here.

The TSP is a tax-advantaged account similar to a civilian 401(k) plan.

If your spouse was covered under the military's legacy retirement system, he or she would have been the source of any contributions made to their TSP account, either through payroll deductions or a rollover of an IRA or outside retirement plan.

However, if your spouse was covered under the Blended Retirement System (BRS), contributions could have also come from their branch of Service in the form of automatic and/or matching contributions.

Visit militarypay.defense.gov/BlendedRetirement for more information.

The TSP is a type of account that is passed on to others through a beneficiary designation, like a life insurance policy. The beneficiary is the person who would receive funds at the service member’s death. The period of transition out of the military is a great time to review beneficiary designations and decide if they are still in line with one’s wishes. It’s also a great time to review the investment allocation, ensure it aligns with your risk tolerance and goals, and then determine how you want to manage these funds upon leaving the military. Read through your options below.

- Leave it in the TSP. This option is available as long as there is at least $200 in the account. Investment allocations can continue to be adjusted in the account, but future contributions are limited to rollovers of IRAs or eligible employer plans.

- Roll it into an Individual Retirement Account (IRA). Your spouse can transfer or roll over the balance of his or her TSP directly into a Traditional or Roth IRA with no tax consequences as long as certain rules are followed.

- Transfer or Roll Over Money to an Eligible Employer Plan. Your spouse should check with his or her employer's HR department to see if this is possible. There is no tax consequence for this type of transfer.

- Withdraw All or Part of Your Money. If your spouse is younger than age 59½, then taxes and penalties may apply. Please read the next section.

Click here for more information on how to manage the TSP when leaving military service.

If withdrawals are taken and your spouse is under the age of 59½, the withdrawal may be subject to a 10% penalty along with ordinary income tax.

Please note, while the TSP is a qualified plan intended to be used for retirement, there are some special situations where the 10% penalty will not apply. Visit this resource on the TSP website for more information.

After transitioning out of the military, you and your spouse may find new jobs that have a workplace retirement plan, such as a 401(k) or 403(b) plan. If your spending plan allows, it's often a smart financial move to contribute at least enough to receive any company match that may be offered.

Also, don’t forget that you can still contribute to an IRA to maximize your retirement savings. The more time your savings have to grow before retirement, the more compound interest you will earn, helping you meet your financial goals.

You likely have wills, powers of attorney, and/or medical directives in place, but are they up to date? This is a great time to get these estate documents completed or updated. If you already have these documents in place, review them and make sure they are in line with your current wishes. Your installation’s legal office can aid you in the process.

Also, review the beneficiaries on your life insurance policies and investment accounts to make sure they are up to date.

Visit Military OneSource for more information on the importance of estate planning.

It is difficult to consider a time when you may not be around to take care of your family, but taking the time to have an estate plan in place gives you peace of mind.

Watch this short video to learn about "The 5 Key Estate Documents."

Once your spouse leaves the military, they are issued a form called a DD214. This Report of Separation contains information needed to verify military service benefits and more. This should be checked for accuracy and a certified copy should be kept in a safe place. For more information, click here.

3

Resources

Here are some additional resources available to assist your transition: