We’re often told NOT to stick our heads in the sand when times get tough, right? Well, when it comes to market volatility, that might be one winning strategy! It’s possible to see a well-diversified portfolio recover if you exercise some patience.

Sometimes people make investment decisions based on emotion, and this can lead to costly mistakes. You may hear about people selling off their investments and “going to cash” when the market is down or changing their long-term investment strategy based on today’s headlines. The problem with getting out of the stock market with the intent of going back in is that you must guess correctly TWICE — when to get out and when to get back in. If only we had a crystal ball.

A look into the future would reveal the stock market can go one of three directions: up, down or remain flat. The fluctuations you see in the market on a daily, weekly, or monthly basis are called market volatility. They happen for a variety of reasons, but it is important to know it is normal.

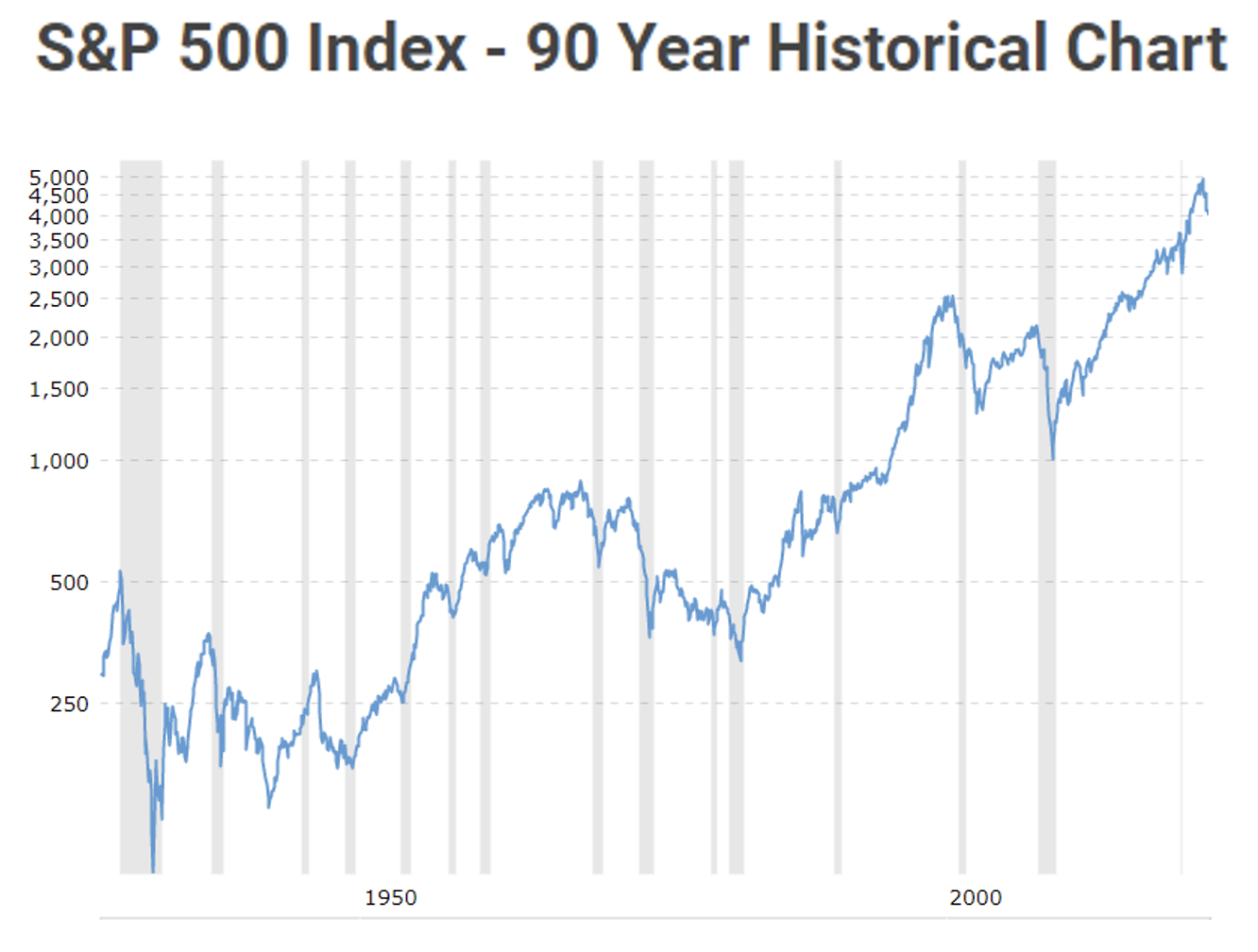

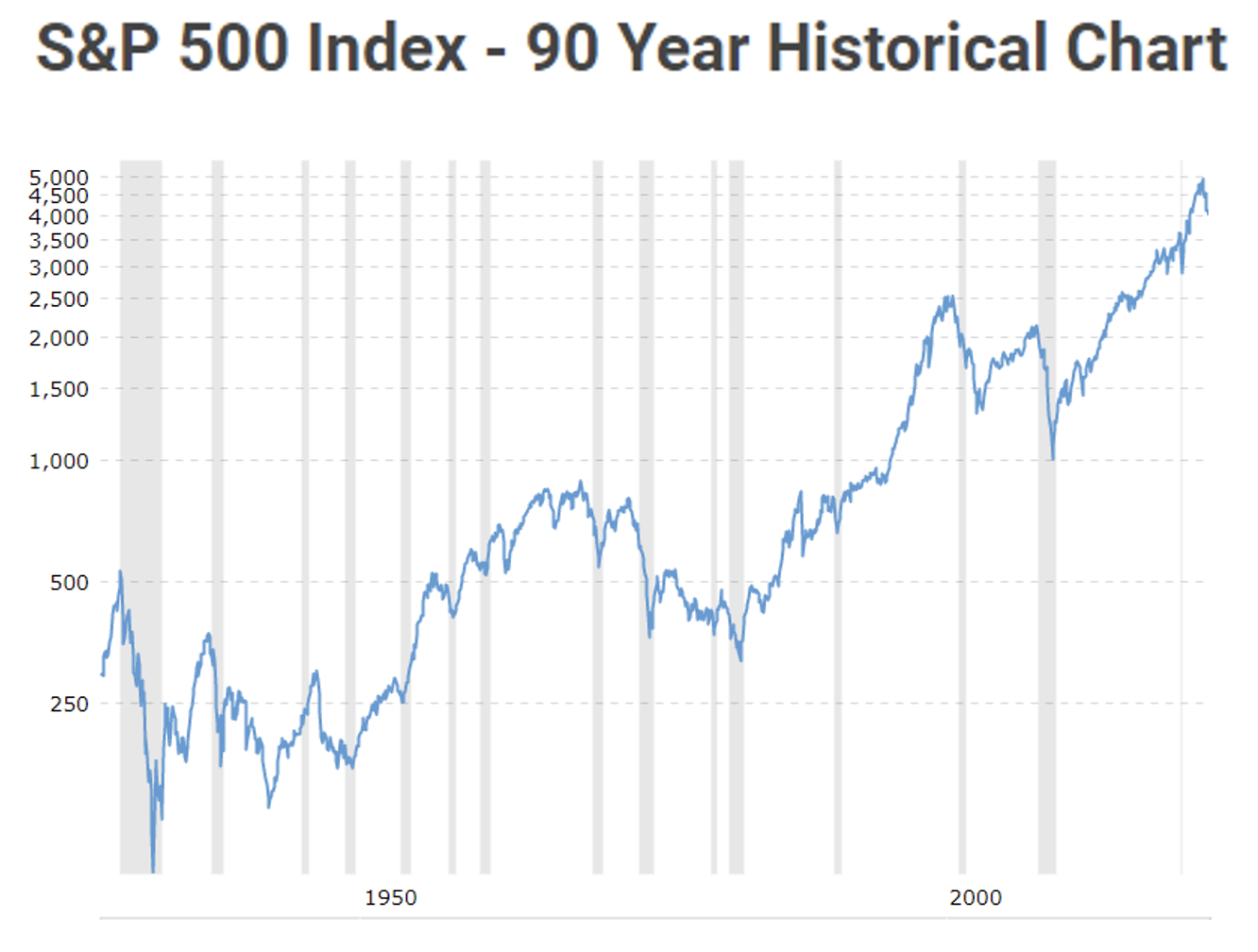

Here is an example to illustrate market volatility and why patience can be a virtue. The S&P 500 (the biggest 500 publicly traded U.S. companies) shows an average annual return of 10.5% since its inception through 2021. However, it doesn’t go up 10.5% every year. In fact, the S&P 500 lost over 13% in 2001 and 38% in 2008, but also experienced gains of 29.6% in 2013 and 28.9% in 2019. As you look at the historical trend line below, the market over time has gone up and to the right. When it comes to market volatility, you often need to endure the tough times to enjoy the good ones!

Since no one can predict the markets, here are a few strategies to keep in mind during volatile times:

- Avoid the rush to check account balances. Unless it’s necessary, don’t log in or review your statements constantly. During volatile times, we often make emotional decisions. Over time, a well-diversified portfolio will balance out, so patience is a virtue in these circumstances.

- Keep things in perspective. Investing involves taking some degree of risk with your money. This means you can — and likely will — see your investments go down in value at some point. If you’re a long-term investor who invests automatically (Dollar Cost Averaging), then you may find market volatility translates into buying more shares at lower prices and your strategy is working to plan.

- Review your plan. A disciplined investor can articulate their investing goals, strategy, time horizon and appetite for risk. Here are a few questions to keep in mind:

- What is my approach to investing?

- What goal am I trying to achieve with my investment(s)?

- When do I need to access my investment(s)?

- How much risk am I willing to take for this goal?

- What returns can I reasonably expect?

- What period of time did I expect to see this return?Finding answers to these questions can provide clarity, direction and peace of mind. For long-term goals, like retirement, you may have many years or even decades before you need to access the account, so exercising patience might be in order. However, if your investment is intended to cover your child’s college education in the next few years, then it might be time to evaluate your risk tolerance and consider shifting some of the funds into safer investments as each year of college expenses nears. By building time into your investment plan to make this investment shift strategically, you may be able to wait out dips in the market.

- Stick to your plan. When it comes down to it, you can take steps to invest wisely, but you don’t have control over how the markets will ultimately perform. Do your best to educate yourself on diversification, rebalancing, and minimizing investment fees. At the end of the day, create an investment plan and stick to it. These steps are within your control and can go a long way toward creating peace of mind when the market roller coaster is off and running.

Volatility with significant ups and downs is a normal part of how the stock market operates. The Securities and Exchange Commission warns against making any rash decisions during volatile markets. Be informed and patient while sticking to your long-term plan as you weather market volatility and secure your financial future. Visit this Don’t Panic, Plan it! article by the SEC for more great tips!

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!

MilLife Milestones

Budget and Insurance: What to Do After You PCS

After months of planning and hard work, you’ve landed safely at your next duty station. Congratulations! As you…

Read MorePersonality Quiz

Next Blog

We’re often told NOT to stick our heads in the sand when times get tough, right? Well, when it comes to market volatility, that might be one winning strategy! It’s possible to see a well-diversified portfolio recover if you exercise some patience.

Sometimes people make investment decisions based on emotion, and this can lead to costly mistakes. You may hear about people selling off their investments and “going to cash” when the market is down or changing their long-term investment strategy based on today’s headlines. The problem with getting out of the stock market with the intent of going back in is that you must guess correctly TWICE — when to get out and when to get back in. If only we had a crystal ball.

A look into the future would reveal the stock market can go one of three directions: up, down or remain flat. The fluctuations you see in the market on a daily, weekly, or monthly basis are called market volatility. They happen for a variety of reasons, but it is important to know it is normal.

Here is an example to illustrate market volatility and why patience can be a virtue. The S&P 500 (the biggest 500 publicly traded U.S. companies) shows an average annual return of 10.5% since its inception through 2021. However, it doesn’t go up 10.5% every year. In fact, the S&P 500 lost over 13% in 2001 and 38% in 2008, but also experienced gains of 29.6% in 2013 and 28.9% in 2019. As you look at the historical trend line below, the market over time has gone up and to the right. When it comes to market volatility, you often need to endure the tough times to enjoy the good ones!

Since no one can predict the markets, here are a few strategies to keep in mind during volatile times:

- Avoid the rush to check account balances. Unless it’s necessary, don’t log in or review your statements constantly. During volatile times, we often make emotional decisions. Over time, a well-diversified portfolio will balance out, so patience is a virtue in these circumstances.

- Keep things in perspective. Investing involves taking some degree of risk with your money. This means you can — and likely will — see your investments go down in value at some point. If you’re a long-term investor who invests automatically (Dollar Cost Averaging), then you may find market volatility translates into buying more shares at lower prices and your strategy is working to plan.

- Review your plan. A disciplined investor can articulate their investing goals, strategy, time horizon and appetite for risk. Here are a few questions to keep in mind:

- What is my approach to investing?

- What goal am I trying to achieve with my investment(s)?

- When do I need to access my investment(s)?

- How much risk am I willing to take for this goal?

- What returns can I reasonably expect?

- What period of time did I expect to see this return?Finding answers to these questions can provide clarity, direction and peace of mind. For long-term goals, like retirement, you may have many years or even decades before you need to access the account, so exercising patience might be in order. However, if your investment is intended to cover your child’s college education in the next few years, then it might be time to evaluate your risk tolerance and consider shifting some of the funds into safer investments as each year of college expenses nears. By building time into your investment plan to make this investment shift strategically, you may be able to wait out dips in the market.

- Stick to your plan. When it comes down to it, you can take steps to invest wisely, but you don’t have control over how the markets will ultimately perform. Do your best to educate yourself on diversification, rebalancing, and minimizing investment fees. At the end of the day, create an investment plan and stick to it. These steps are within your control and can go a long way toward creating peace of mind when the market roller coaster is off and running.

Volatility with significant ups and downs is a normal part of how the stock market operates. The Securities and Exchange Commission warns against making any rash decisions during volatile markets. Be informed and patient while sticking to your long-term plan as you weather market volatility and secure your financial future. Visit this Don’t Panic, Plan it! article by the SEC for more great tips!

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!

MilSpouse Money Mission® is a Department of Defense resource that offers FREE personal financial education specifically geared toward spouses. There is a Money Ready guide for various stages of financial life, a MilLife Milestones section to help you through the big moments in your military journey, a blog, spouse videos, quizzes, calculators and more!